Finance and banking intranets: Why you need them in 2023 and beyond

Banking intranets (or finance intranets) are quickly becoming a staple on a global scale. In the fast-paced world of financial services, staying ahead of the curve is like manoeuvring through a constantly shifting maze. The financial landscape is unpredictable and to navigate these conditions you need a reliable roadmap – a secure and integrated platform that not only keeps your team connected and well-informed but is also capable of guiding you through the twists and turns of the financial sector. In any business, effective communication is a well-founded requirement. In finance, it's a necessity. In fact, 86% of employees actively cite poor communication as a reason that they can attribute most of their failures. In the financial industry, poor communication costs money.

Despite their pivotal role in the global economy, financial institutions grapple with a number of challenges related to employee engagement, communication and more. Obstacles may arise by rapid technological advancements, market fluctuations, and regulatory changes, requiring constant adaptation. This constant state of flux can leave employees feeling overwhelmed or even disconnected unless they are equipped with the right tools and information. Enter finance intranets.

The specialised nature of financial services requires employees to possess a deep understanding of complex financial products and ever-changing regulations. Ensuring that all team members remain well-informed and up-to-date can pose a significant challenge. The paramount concern of data security further compounds the stresses and difficulties faced by financial institutions. Handling vast amounts of sensitive information requires a meticulous focus on cybersecurity.

According to Security Intelligence, an online news outlet, a finance business loses approximately £5 million through every breach. Striking a balance between stringent data protection and maintaining seamless communication is a delicate and often precarious responsibility. If this wasn’t already shocking enough, it’s 28% higher than the global average. When it comes to banks, a banking intranet is not only a prerequisite for organisation, alignment and productivity but often acts as frontline security.

📖 Recommended reading: 5 ways intranets can prevent loss information

Often the traditional hierarchical structure found in financial organisations can act as a barrier to effective communication and idea sharing. Encouraging open dialogue and fostering collaboration becomes incredibly important, as siloed departments can hinder innovation and teamwork.

Striving to tackle these challenges head on, forward-thinking financial institutions (like us) have manufactured solutions designed to enhance employee engagement, streamline communication and address these complex issues proactively. We work with some of the biggest financial institutions in the UK. Because of this, we ensure that we adhere to the most stringent data policies and engineer our solutions with safety in mind.

“We envisioned a tool that not only empowers employees with the knowledge and resources they need to navigate this complex landscape of industries like finance but also serves as a bridge that connects teams, breaking down traditional silos. Our aim is to provide a secure, adaptable, and user-friendly platform that not only addresses these issues head-on but also positions financial institutions at the forefront of innovation in the industry. Our intranet solution is not just a product; it's a commitment to transformation and growth in an ever-evolving financial world.”

David Ferguson - Director of Product, Oak Engage

Relevance of intranets in the financial industry

What is the role of an intranet in finance management? In the financial industry, finance intranets have become indispensable platforms that serve as linchpins for security, communication and compliance.

These internal networks offer a secure repository for sensitive financial data and enable real-time communication, breaking down departmental silos. Intranets also promote knowledge sharing, keep professionals updated on market trends and regulatory changes. They streamline cross-departmental collaboration, boost efficiency and ensure stringent compliance and documentation requirements are met.

Furthermore, in an increasingly remote work-oriented landscape, intranets continue to provide essential support for dispersed teams, ultimately granting financial institutions a competitive advantage through operational agility and innovation.

Engagement in financial services

In an industry as dynamic as financial services, keeping your workforce engaged is a top priority. Oak Engage is designed to deliver a personalised and engaging experience to all employees, enhancing their connection with your organisation. It includes features like curated newsletters, push notifications and mandatory reads, ensuring that your employees never miss essential updates. This level of engagement is exemplified by NatWest, where Oak Engage has played a pivotal role in achieving over 95% employee engagement among its 46,000 employees, as endorsed by Alan Harris, Director of Internal Communications.

Data security a top priority

Financial services operate within one of the most heavily regulated industries, where data security and risk management are paramount. As the industry adopts new technologies, regulations evolve accordingly. Oak Engage recognises the importance of safeguarding your data. That's why we host all your data and content on Microsoft Azure, one of the world's most secure and trusted platforms. With Oak Engage, you can rest assured that your sensitive information is protected at the highest level.

Deliver a consistent experience

In the era of multichannel communication, delivering a consistent level of service is increasingly crucial. Your employees must always stay one step ahead, and Oak Engage helps you achieve just that. The platform enables you to quickly communicate critical news through curated newsletters and push notifications, all with personalised content. With Oak Engage, your employees will always be in the know, never missing a beat.

Transforming the employee experience

Unifying your customer experience begins with your employees. Oak Engage empowers your workforce with an adaptive platform that offers easy accessibility and seamless integrations with your favourite business tools. This consolidation enhances productivity by providing employees with everything they need in one secure place. Moreover, Oak Engage's dedicated reporting functionality allows you to measure employee interaction with your intranet, ensuring that you can adapt and optimise as needed.

Challenges faced by the financial industry that intranets can address

Finance intranets can play a significant role in addressing problems faced by the financial industry. Generally speaking, intranets can help businesses:

- Streamline processes

- Improve productivity

- Stimulate effective comms

- Knowledge share

- Engage employees

Information sharing and collaboration:

Financial institutions often deal with vast amounts of data and require seamless collaboration among teams and departments. Intranets provide a centralised platform for sharing information, documents, and reports securely. This enhances communication and collaboration, improving overall productivity and decision-making.

Data security and compliance

The financial industry is highly regulated, and data security is paramount. Intranets can be designed with robust security features to ensure sensitive financial information is protected. They can also facilitate compliance by providing easy access to regulatory documents and guidelines.

Knowledge management

In a rapidly evolving industry, keeping employees up to date with the latest financial products, market trends and compliance requirements is essential. Intranets can serve as knowledge repositories, housing training materials, industry news and best practices. This helps employees stay informed and competent.

Internal communication

Effective internal communication is crucial for keeping employees aligned with the company's goals and strategies. Intranets can host internal newsletters, announcements and forums for discussions, fostering a sense of belonging and transparency.

Cost reduction

By digitising and centralising information and processes, intranets can help financial institutions reduce costs associated with paper-based documentation, physical storage and redundant administrative tasks.

Scalability

As financial institutions grow, intranets can easily scale to accommodate increasing data volumes, users and functionalities, ensuring that IT infrastructure supports business growth.

Employee engagement

Engaged employees are more likely to deliver exceptional customer service. Intranets can incorporate gamification elements, surveys and feedback mechanisms to boost employee engagement and satisfaction.

In summary, intranets can address various challenges faced by the financial industry, including information sharing, data security, compliance, knowledge management and workflow optimisation. Implementing an effective intranet can enhance operational efficiency, reduce risks and improve overall competitiveness in the financial sector.

Financial services intranet features

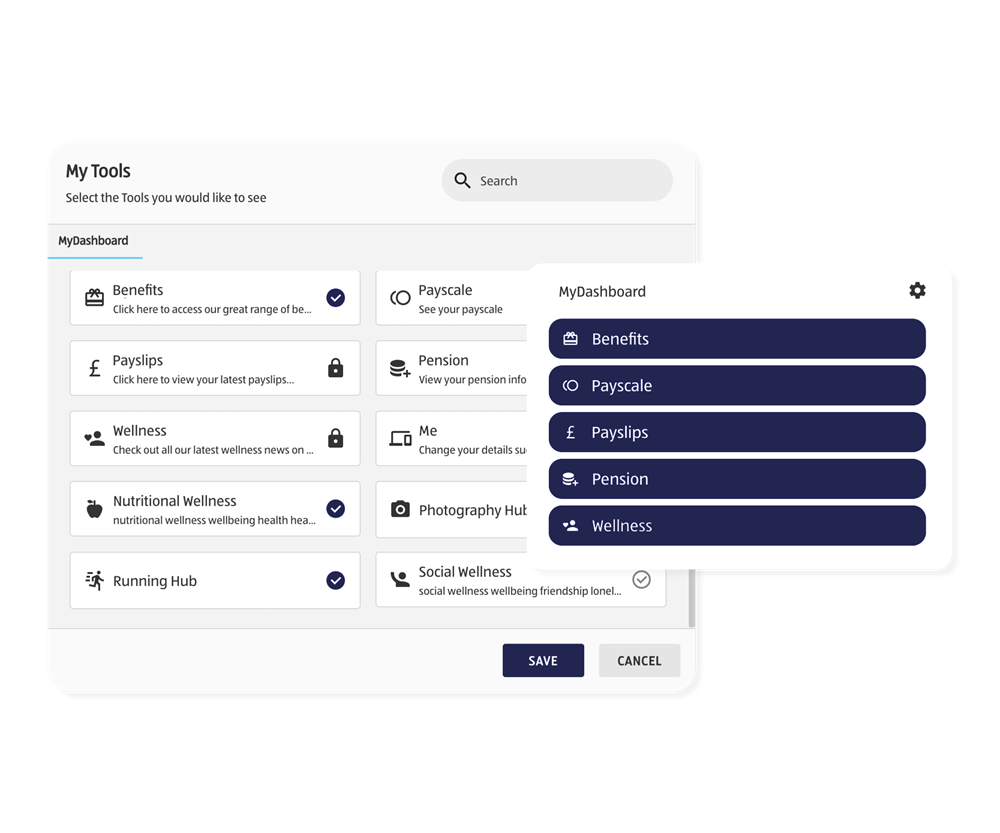

At Oak Engage we provide a variety of intranet features that enhance and improve the employee experience across many financial organisations.

Mobile app

Oak Engage provides an immersive mobile experience, giving employees remote access to their company intranet. Oak Engage features an intuitive and user-friendly mobile interface, emphasising accessibility for employees of all technical backgrounds and promoting efficient utilisation.

Moreover, it offers unparalleled flexibility with remote access, enabling employees to connect to the company's intranet from anywhere globally, thereby supporting flexible work arrangements, remote productivity, and on-the-go access to vital resources.

Homepages

Bring your intranet to life with unique and interactive homepages, creating a more engaging and user-friendly environment. These personalised and interactive hubs serve as the gateway to a wealth of information, fostering a sense of community and ownership among employees. With customisable widgets, real-time updates, and engaging multimedia content, employees are not only informed but also inspired to actively participate in the digital workplace.

This transformation enhances the overall user-friendliness of the platform, making Oak Engage the go-to solution for creating a vibrant and interactive company intranet.

Extranet

Streamline interactions with third parties through our cloud-based extranet software, facilitating secure and efficient communication. This feature facilitates secure and efficient communication with suppliers, partners, and clients, ensuring that critical collaborations and exchanges of information occur seamlessly. With robust security measures in place, including encryption and access controls, you can trust that sensitive data remains protected while you effortlessly connect and collaborate with external stakeholders.

Oak Engage's integrated extranet functionality not only simplifies external interactions but also strengthens your organisation's reputation as a reliable and tech-savvy business partner in today's interconnected digital landscape.

Advanced search

Offer employees instant access to the information they need, enhancing their productivity and efficiency. With a single tap, employees can retrieve critical documents, company policies, training materials, and real-time updates.

This swift access eliminates the need for time-consuming searches and inquiries, allowing employees to focus on their tasks and responsibilities with confidence. By providing this seamless flow of information, Oak Engage empowers employees to make informed decisions quickly, fostering a more agile and responsive workforce that is better equipped to meet the demands of today's fast-paced business environment.

Knowledge base

Provide employees with valuable information and support, helping them get the most out of your workforce. Oak Engage is designed to empower employees by providing them with easy access to valuable information and support.

This not only simplifies their daily tasks but also cultivates a sense of self-reliance. Additionally, it offers robust support channels like FAQs, chat support, and discussion forums, fostering a collaborative and informed workforce. In essence, Oak Engage helps employees get the most out of their work experience, leading to enhanced job satisfaction and overall productivity.

Implementing a financial intranet

Implementing a financial intranet requires a strategic approach. Implementing Oak Engage is a streamlined and efficient process, designed to minimise disruption and maximise the benefits of the platform swiftly. With user-friendly customisation options that allow organisations to align Oak Engage with their unique brand and objectives, the initial setup is quick and hassle-free.

Additionally, comprehensive training sessions ensure that employees can easily navigate and utilise the platform's features effectively. The platform's flexibility allows for phased deployments, enabling organisations to gradually introduce Oak Engage to different teams or departments, ensuring a smooth transition. Oak Engage's intuitive interface and robust support make it remarkably straightforward to implement, delivering enhanced communication, collaboration and engagement without extensive time or resource commitments.

When implementing an intranet, make sure that the team around you are technically capable and suitably equipped to deal with the task at hand. Having the right stakeholders and representatives (i.e different but relevant departments) involved from the outset will help the project run smoothly and reduce the chances of obstacles further down the line.

Here are a few standard requirements that you should bear in mind prior to implementation.

Requirement |

Description |

Implications for Intranet Implementation |

|---|---|---|

| Technical Proficiency | Technical skill level of employees | Tailor the intranet's complexity to match the technical proficiency of users. Provide training and support as needed. |

| Age and Generational Differences | Age range of the workforce | Design a user-friendly interface that accommodates different age groups and their digital preferences. |

| Work Styles | Work habits, preferences, and productivity styles | Customise the intranet to support various work styles (e.g., remote work, collaborative workspaces, task management). |

| Communication Styles | Communication preferences (e.g., email, chat, video) | Integrate various communication tools and channels within the intranet to cater to different preferences. |

| Language and Cultural Diversity | Languages spoken within the organization | Provide multilingual support and culturally sensitive content to ensure inclusivity. |

| Accessibility Needs | Disabilities or accessibility requirements | Ensure the intranet is compliant with accessibility standards (e.g., WCAG) to accommodate users with disabilities. |

| Security Awareness | Awareness of cybersecurity best practices | Educate users about security protocols and promote safe online behaviours within the intranet. |

| Change Management | Willingness and readiness to adapt to change | Implement a change management strategy to address resistance and ensure a smooth transition to the intranet. |

| Cognitive Styles | Cognitive diversity in problem-solving approaches | Provide tools and resources that cater to different thinking and problem-solving styles. |

1. Assessment

Unique Needs and Objectives: Begin by thoroughly assessing your organisation's specific needs and objectives. This involves identifying pain points, communication gaps and areas where an intranet solution like Oak Engage can provide the most value. This initial step is crucial to tailor the intranet to address your organisation's specific challenges and goals.

2. Customisation

Customise Oak Engage to align with your organisation's brand identity and strategic objectives. This may involve incorporating your company's logo, colour schemes and branding elements into the intranet's design.

3. Configuration

Configure the platform to meet your organisation's unique communication and collaboration requirements. This can include setting up specific communication channels, access permissions and integrating relevant tools or applications.

4. Training

To ensure successful adoption, conduct training sessions for employees to familiarise them with Oak Engage's features and capabilities. Training should cover how to navigate the intranet, use collaboration tools, access resources, and participate in discussions or forums. Well-trained employees are more likely to make the most of the new intranet and use it effectively.

5. Pilot testing

Launch a pilot phase where a select group of users within your organisation can access Oak Engage. During this phase, gather feedback from pilot users to identify any issues, usability concerns, or areas for improvement.

6. Adjustments

Based on the feedback received, make necessary adjustments and refinements to the intranet platform. This iterative process ensures that the final product is well-tailored to the organisation's needs and user-friendly.

7. Deployment

Gradual Rollout When deploying Oak Engage to the entire organisation, consider a gradual rollout or a phased approach. This approach helps ensure a smooth transition and minimises disruptions. You can start with specific departments or teams and gradually expand access.

8. Communication and support

Provide clear communication to employees about the deployment plan, timeline and how to access the intranet. Offer ongoing support and assistance to address any questions or challenges that may arise during the deployment phase.

📚 Download your internal comms guide for financial services here

Industry standard intranet launch plan

For an idea as to how long a typical launch process may take, we've mapped out a typical timeline below. With Oak Engage, we know how important it is that you're able to reap the rewards of better communication sooner. If you want to find out more about how fast we can get the ball rolling - speak to an expert today.

Weeks 1-2

Project Initiation and Planning.

Weeks 2-3

Assemble an implementation team consisting of IT experts, project managers, and key stakeholders from various departments.

Weeks 3-4:

Conduct a thorough needs assessment to identify specific goals and requirements. Define clear objectives for the intranet, focusing on improving communication, collaboration and training.

Weeks 5-6:

Develop a comprehensive project plan that outlines key milestones, defines roles and responsibilities and provides a preliminary budget estimate. Create a project charter to secure executive buy-in and commitment.

Weeks 7-8:

Initiate research and evaluation of intranet solution providers specialising in retail needs. Request proposals and conduct interviews with potential vendors.

Weeks 9-10:

Select a vendor and finalise the contract. Proceed with the development of a detailed system design, encompassing aspects such as user interface design, functionality specifications and seamless integration with existing systems.

This structured approach is crucial for ensuring the successful implementation of a retail intranet, as it lays the foundation for effective communication, collaboration and training across the organisation.

Oak Engage: Leading UK finance intranet solution

We’re an award-winning intranet solution that has forged partnerships with some of the world’s most prominent financial institutions. We help businesses in the financial sector harness powerful communication capabilities while ensuring their data remains safe and sound. In the fast-paced world of finance, Oak Engage has become a go-to solution for organisations looking to revamp their internal communication strategy. Our platform consistently elevates employee engagement and productivity, and we're proud to be the trusted choice for high-profile financial institutions.

Effortless communication

Oak Engage simplifies internal communication with a user-friendly approach. Our suite of tools fosters seamless collaboration across teams and departments, promoting knowledge sharing and teamwork. Plus, our robust security measures ensure that sensitive data stays protected, aligning perfectly with the stringent security requirements of the finance industry.

Unmatched security

Oak Engage stands as the ultimate finance intranet, addressing the specific demands of the financial sector with a strong focus on data security. The platform is hosted on Microsoft Azure, a trusted cloud platform known for its robust security measures, data encryption capabilities and strict compliance adherence. In an industry where safeguarding sensitive financial data and adhering to stringent regulatory standards are non-negotiable, this choice of hosting ensures data confidentiality, integrity and availability.

Enhanced engagement

Achieving over 95% employee engagement, as seen at NatWest, Oak Engage places a high priority on keeping employees engaged. A key driver of this high engagement rate is the platform's emphasis on personalisation. By tailoring content to individual employee preferences and roles, Oak Engage ensures that every piece of information received is relevant and meaningful. This personalised approach fosters a strong sense of connection and engagement with the platform.

Seamless collaboration

In the finance sector, where collaboration often spans across different geographies, Oak Engage offers seamless collaboration features. Its mobile app and social intranet facilitate real-time communication, document sharing and project collaboration, empowering finance professionals to work together efficiently and effectively. This support for remote teamwork and knowledge sharing is invaluable in a globally connected industry.

Personalised experiences

Personalised communication is another hallmark of Oak Engage. Curated newsletters present information in an organised and digestible format, ideal for the finance sector where market updates, policy changes and financial reports are frequent. Push notifications proactively deliver essential and relevant messages to all employees, ensuring that vital information reaches its intended recipients promptly, regardless of their location or device.

📖 Recommended reading: Are intranets still relevant?

Oak Engage case study - NatWest

NatWest Group, a prominent player in the financial industry, embarked on a transformative journey with Oak Engage to enhance engagement among its vast workforce of 85,000 employees. Their collaboration with Oak Engage resulted in an award-winning intranet, celebrated as the "Best Intranet" at the prestigious Institute of Internal Communication Awards in 2022.

Industry: Finance | Number of users: 85,000 | Coverage: Global

Underpinned by Oak Engage's innovative platform, NatWest witnessed remarkable outcomes:

99% monthly engagement: The implementation of Oak Engage achieved an astounding 99% monthly engagement rate, signifying a highly active and involved employee base.

70% reduction in homepage stories: By leveraging Oak Engage's Smart Delivery feature, NatWest significantly reduced the clutter on their homepage, enhancing the clarity and impact of their communication.

89% newsletter sign-up rates: The introduction of personalised newsletters led to an impressive 89% sign-up rate, demonstrating the resonance of Oak Engage's tailored approach.

The challenge: Unifying Communication Across Legacy Platforms

Before adopting Oak Engage, NatWest grappled with a fragmented communication landscape. Multiple intranets, built on outdated legacy platforms, led to disjointed news distribution and confusion among employees. Oak Engage emerged as the clear choice to remedy this situation, offering a modern platform with an intuitive user experience that served as a comprehensive "one-stop shop" for all their communication needs.

"We selected Oak Engage as the clear winner for our new intranet. Their modern platform with intuitive UX is something we knew they did extremely well, offering a ‘one stop shop’ for everything we needed."

Digital Manager at NatWest

Personalised news experience

Oak Engage introduced a game-changing approach to news delivery. Powered by algorithms, this feature minimises information overload by presenting content tailored to individual preferences. This transformation allowed NatWest to declutter their homepage and allocate space more effectively.

"Oak Engage has transformed the way we communicate, delivering a single news feed which aligns with our ‘one bank’ strategy. Consolidating our offering has created a clear channel for communications and a single source of truth. We're already seeing positive engagement from colleagues."

Alan Harris, Director of Internal Communications at NatWest

Single source of truth and enhanced productivity

NatWest streamlined communication further with a daily news round-up email that delivers the latest updates directly to employees' inboxes. This not only prevents information from getting lost but also tailors content based on user preferences and behaviour, creating a highly personalised newsletter experience. Oak Engage also seamlessly integrates with third-party applications, including Workplace by Meta, providing employees with a targeted and personalised feed that optimises productivity.

Measuring success: Insights from analytics

NatWest measures the success of Oak Engage through its robust analytics, ensuring that the right message reaches the right people. These insights also help track campaign success and audience reach. Continuous monitoring and periodic reviews allow NatWest to refine their communication strategy and improve engagement continually.

"Oak will be a critical component of our strategy on how we communicate with our people. We will continue to invest and make changes to the platform to ensure our people are getting the most out of their intranet."

Barry Fuller, Digital Communications Consultant at NatWest

In collaboration with Oak Engage, NatWest has not only transformed its digital employee experience but also set a benchmark for excellence in communication and engagement within the finance industry.

If you would like to find out how you can implement a solution like Oak Engage at your business, talk to our team of experts to find out more.